Author: O.K. Hogan | REALTOR®/BROKER, CCIM, SFR

When I first started spending summers in Carteret County more than 30 years ago, I fell in love with the salt air, friendly neighbors, and easy pace of life. Back then, buying a home felt like something you could do over coffee with a handshake and a smile.

But times have changed.

These days, buying a home, whether it's your first or not, comes with a mountain of paperwork, legal considerations, negotiation tactics, and digital listings that update by the second. And yet, I still meet folks who say, “I’m just going to skip the real estate agent and figure it out on my own.”

I’ve been around long enough to tell you this: That decision can cost you far more than just time. As someone who’s worked in numbers my whole life and now helps clients navigate real estate through Star Team Real Estate, I can confidently say that skipping a buyer’s agent is one of the riskiest financial moves you can make.

Let’s walk through the five major things that could go wrong when you go it alone, and why having the right agent by your side can save you more than just headaches.

1. You Might Overpay Without Realizing It

One of the biggest misconceptions I hear is: “I’ll save money by not using a buyer’s agent.” I understand the logic; it sounds like you’re cutting out the middleman. But in reality, you're often cutting out your only advocate.

Buyer’s agents are trained negotiators. They know the market. They know when a home is priced fairly, or not. And they know how to make offers that protect your wallet.

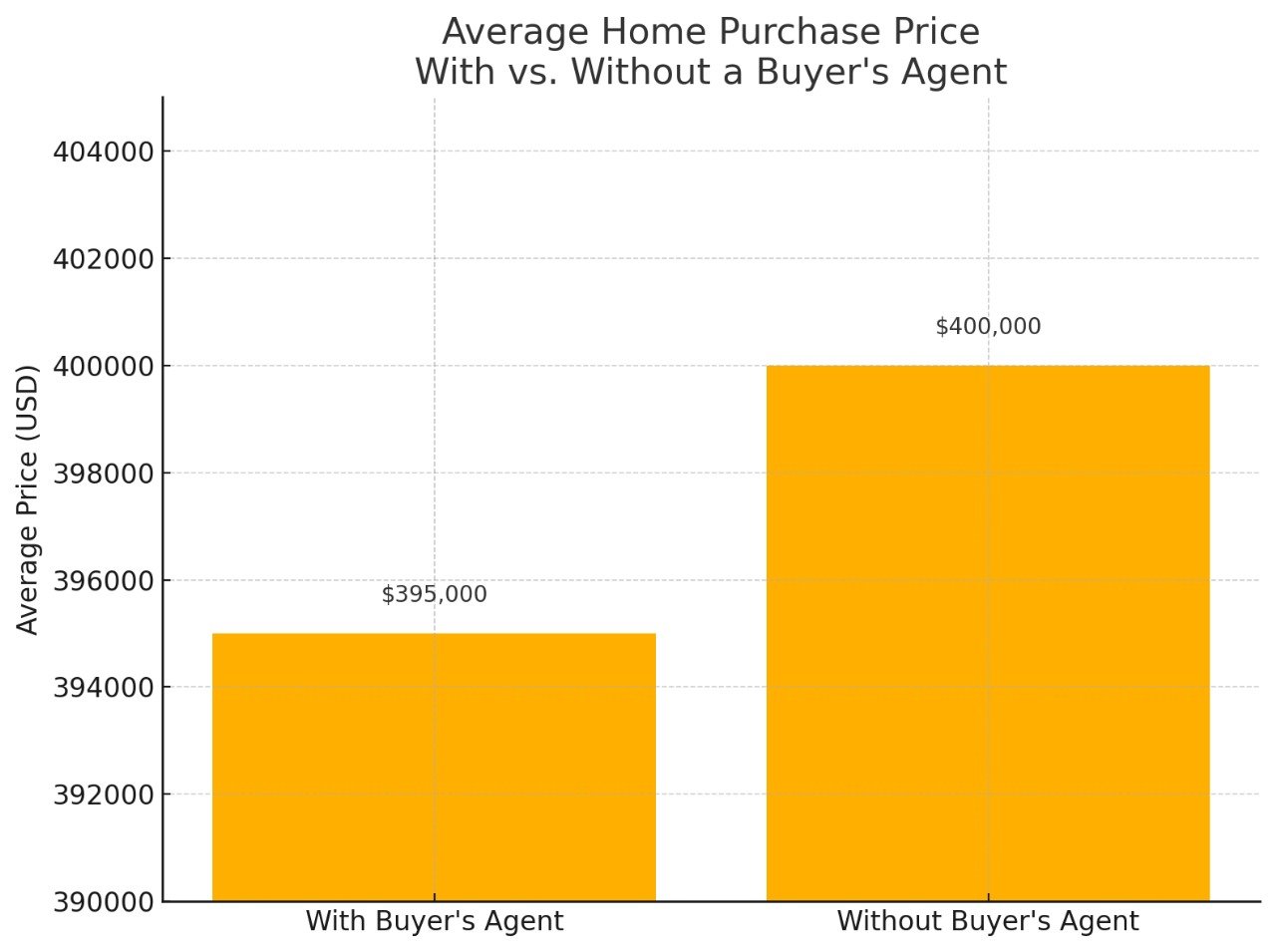

A 2008 Consumer Reports study (referenced in the real estate trends section of Wikipedia) found that buyers who used a dedicated buyer's agent saved an average of $5,000 compared to unrepresented buyers.

I once worked with a couple relocating from Raleigh who were determined to buy without an agent. They found a home they liked, made an offer, and were about to sign when they decided to have me look over the deal. It turned out the home had been sitting on the market for 90 days, and the price was about $25,000 over what similar properties had recently sold for.

With the help of a good agent, they renegotiated, and walked away with keys and a sizable discount.

Moral of the Story: Sometimes, what you don’t know can hurt your bank account.

2. You Could Miss Major Red Flags in the Home

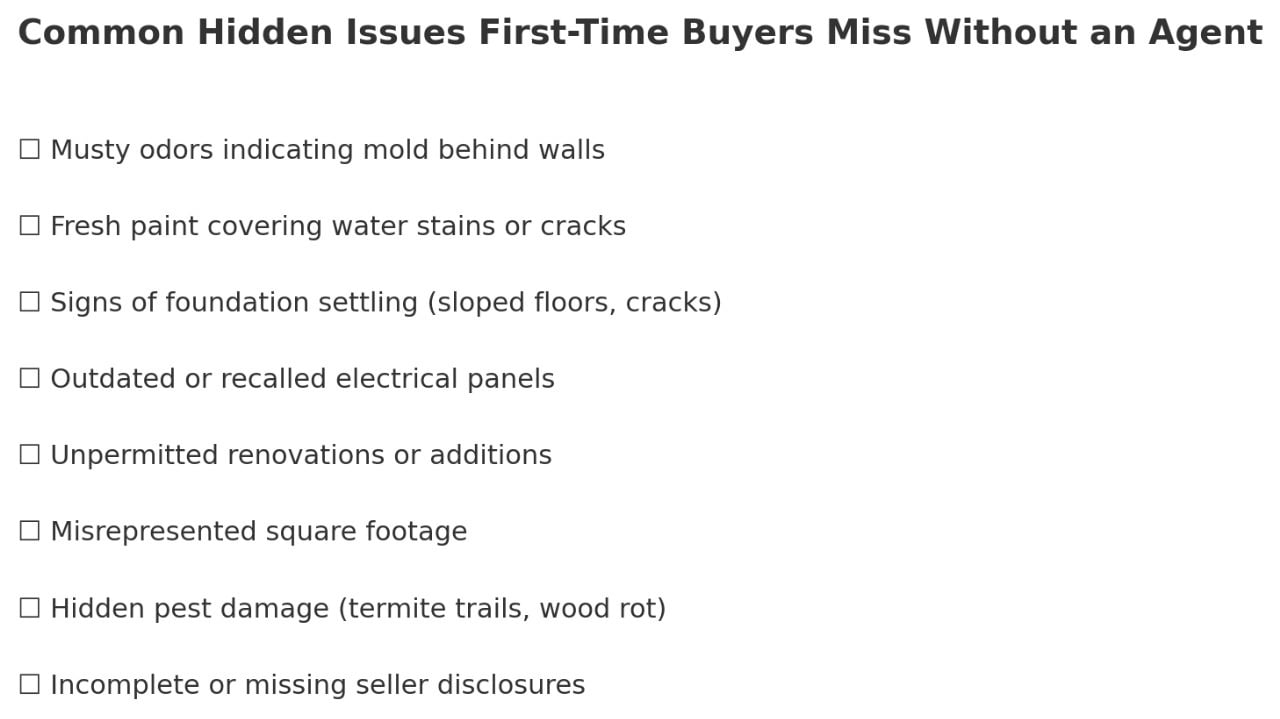

Every home has a story. Some chapters are sunny and bright. Others are more like, “hidden mold in the crawl space” or “foundation cracks behind the drywall.”

Real estate agents aren’t home inspectors, but the good ones know when something feels off. They’ve walked through hundreds, sometimes thousands, of homes. They’ve seen things most people overlook: hairline cracks, telltale signs of poor drainage, outdated wiring, or the smell of a long-covered-up leak.

Without an agent, you’re relying solely on your own eyes—or worse, on what the seller’s agent tells you.

Here’s a real example: A young military couple I helped last year had found a charming home near the coast. Everything looked fine online, but during the walk-through, I noticed something odd; fresh paint in the corner of the garage that didn’t match the rest.

We brought in an inspector, and sure enough, it was covering up water damage from a roof leak. That single observation saved them thousands in future repairs.

Had they been on their own, they might’ve moved in, only to discover the damage after the first rainstorm.

A trusted agent has your back, not just for price, but for protection.

3. The Paperwork Maze Could Trip You Up

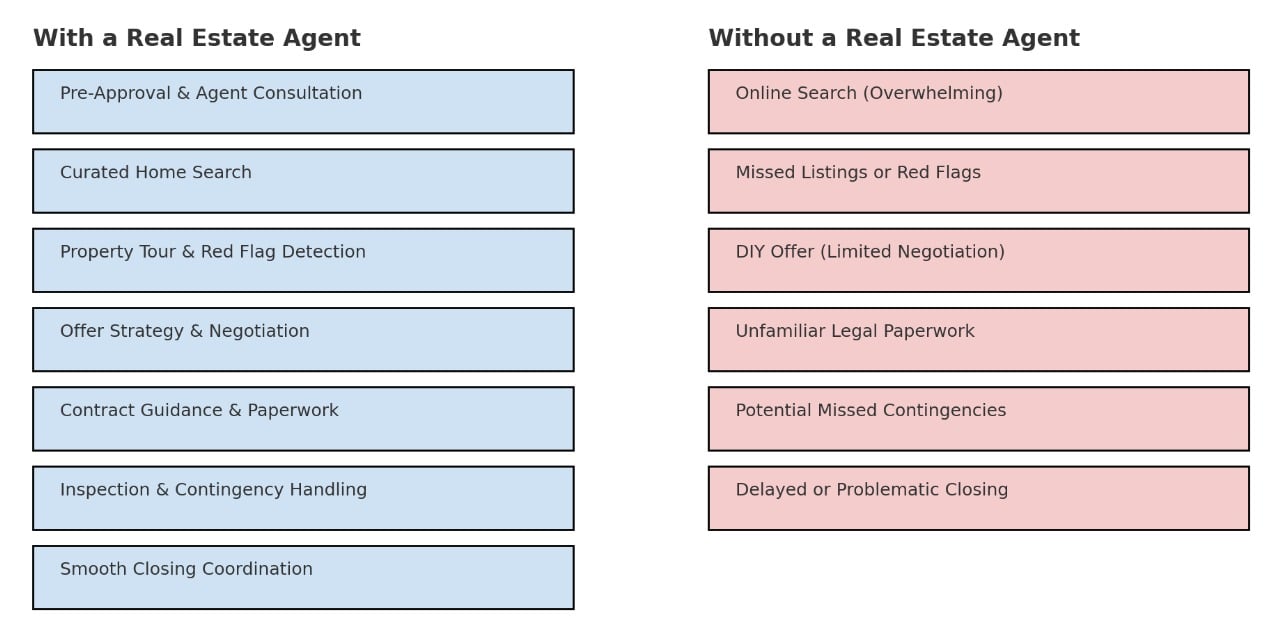

Buying a home means navigating a sea of contracts, addendums, disclosures, and deadlines. And while you don’t need a law degree to understand it all, it sure helps to have someone who knows how the puzzle fits together.

When I was still working as a CPA, clients would sometimes bring me real estate documents to “double check.” I’d explain that contracts in real estate can be legally binding in ways that are easy to misunderstand. One missed clause, like a financing contingency or inspection timeline, can lead to serious financial consequences.

Buyer’s agents know which forms are required, what deadlines are critical, and how to respond when things get tricky. They’re your guide through the legal maze, making sure every I is dotted and every T is crossed.

I’ll never forget one couple who bought a home “for sale by owner” without representation. They accidentally waived their inspection contingency and later discovered the septic system was failing. Fixing it cost nearly $20,000, and they had no legal ground to stand on because the paperwork had been done incorrectly.

That story still keeps me up at night.

4. You’ll Miss Out on Listings You Can’t See Online

Everyone starts their home search online these days. Zillow, Redfin, Realtor.com; they’re great tools, no doubt.

But here’s the thing: those websites don’t show you everything.

Buyer’s agents have access to the MLS (Multiple Listing Service), which includes off-market properties, pre-listings, and homes that aren’t pushed to public sites right away. They also hear about properties through word-of-mouth, especially in tight-knit communities like ours.

When my wife, Lugean, and I were looking for an investment property here in Carteret County, it wasn’t on Zillow. It was on a tip from another local agent. We got in early, made an offer fast, and it’s one of the best investments we’ve made to this day.

So while the internet is a great starting point, it’s only part of the puzzle. If you’re relying on it exclusively, you could miss your dream home entirely.

5. The Process Can Be Emotionally Draining

Buying a home isn’t just a financial decision; it’s an emotional one. You’re making one of the biggest investments of your life, often while juggling family needs, work stress, and moving logistics.

Without a steady hand guiding you, it can be overwhelming.

Good agents don’t just handle paperwork and showings; they offer support, structure, and sanity. They remind you of your goals when emotions run high. They help you stay focused when things feel uncertain.

I’ve walked with families through every kind of situation: downsizing after retirement, relocating for a new job, buying after a divorce. And in all those situations, the difference between chaos and calm was often the agent beside them.

One of my clients, a widowed veteran in his seventies, told me after closing, “I wouldn’t have made it through this without you. You didn’t just help me buy a home. You helped me find peace.”

That’s the kind of difference a real agent can make.

But What About the Commission?

This is the part where folks raise an eyebrow and say, “Isn’t that what the commission is for?”

It’s a fair question. But here’s the truth: in most cases, the seller pays the buyer’s agent’s commission.

So if you’re buying a home, having an agent usually doesn’t cost you a dime; but it could save you thousands.

Even in cases where the buyer contributes to their agent’s fee (which is becoming more common with new commission models), it’s still a wise investment. Think of it like hiring a mechanic before buying a used car. You wouldn’t risk tens of thousands of dollars just to save a small fee.

And just like in accounting or construction, you get what you pay for. A good agent earns their keep tenfold; by protecting your time, your money, and your future.

Final Thoughts: A House Is More Than a Transaction

At the end of the day, buying a home isn’t just about contracts or negotiations; it’s about building a life. It’s about the porch where you’ll drink coffee, the kitchen where you’ll gather with grandkids, the backyard where you’ll watch the seasons change.

I’ve had the joy of helping families make that leap; some right here in Beaufort, others across the bridges of Carteret County.

And I’ve seen firsthand what happens when folks try to do it all themselves. Some get lucky. Others end up regretting it.

If I could give you one piece of advice, not as a retired CPA or CCIM, but as someone who loves this community, it would be this:

Don’t go it alone. A trusted real estate agent isn’t a luxury. It’s a lifeline.

At Star Team Real Estate, we don’t just help people buy homes; we help them make smart, lasting decisions. We walk beside them with experience, integrity, and the kind of local insight that only comes from living here and loving it for decades.

If you’re thinking about buying a home, whether it’s your first, your retirement dream, or your next adventure, I’d be honored to help guide the way. You can reach me anytime at 252-422-2205. Let’s sit down, talk about your goals, and make sure the next chapter in your story starts on solid ground.