Author: O.K. Hogan | REALTOR®/BROKER, CCIM, SFR

For over 30 years, I watched Carteret County change from the eyes of a weekend visitor. Then in 2000, my wife Lugean and I made the move permanent, settling in Beaufort—a decision we’ve never regretted. Now, as someone who helps others make life-changing real estate decisions, I’ve noticed a question that keeps coming up: “Should we sell our home now that the kids are gone, or invest in renovations and stay put?”

If you’re asking yourself this question, you’re not alone. Many empty nesters are weighing the same options. After years of raising a family, the house is full of memories—and maybe also extra space you don’t need, maintenance you don’t want, or stairs you no longer care to climb.

Before you dive into a big renovation project, let’s talk about why selling might just be the smarter path forward.

1. Renovation Return on Investment Isn’t What It Used to Be

A common reason folks lean toward renovating is the belief that it will increase their home’s value. But here's the truth: most major renovations don’t pay back what you put in.

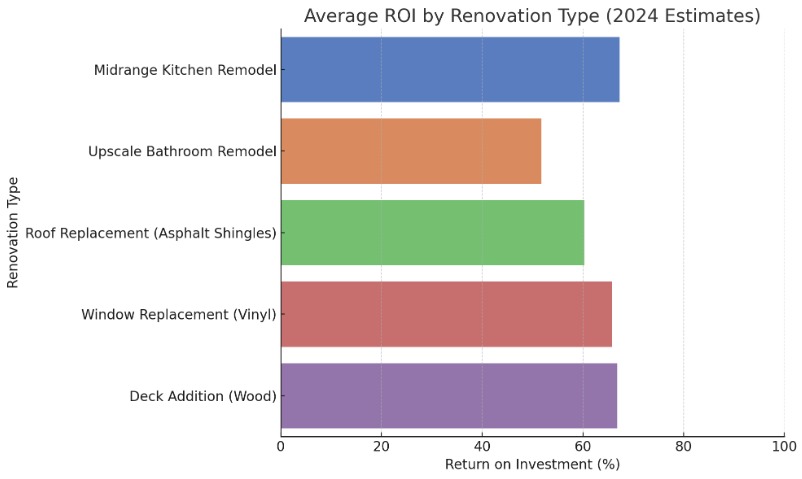

According to the 2024 Cost vs. Value Report, homeowners recoup only about 60% of the cost of a midrange kitchen remodel and less than 52% on upscale bathroom renovations. Those numbers can dip even lower in rural or slower-appreciating markets—like many parts of coastal North Carolina.

To paint a clearer picture, here’s a visual comparison of what common home renovations actually return at resale:

Let me share a story from one of my past clients in Morehead City. They spent nearly $80,000 remodeling their kitchen and bathroom, expecting a solid return when they sold the following year. But the market didn’t reward them the way they hoped. They got compliments during showings—but only a modest bump in sale price.

If your goal is to increase property value, a well-maintained, clean, and staged home often does the job without breaking the bank. Sometimes, less really is more.

2. Empty Nesters Tend to Overspend on Renovations

When the nest is empty, it’s easy to dream big. You've finally got the time and maybe the savings to upgrade your home just the way you want it. But studies show that empty nesters often invest more in renovations than the average homeowner—and not always wisely.

A 2023 report by Nationwide found that empty nesters spend roughly 70% more on home improvement projects than younger homeowners. Kitchens, outdoor spaces, and custom upgrades top the list.

To put that into perspective, here’s a look at how renovation spending compares across age groups:

The trouble? Many of these upgrades don’t align with what younger buyers are looking for. The new buyer might love your quartz countertops but have no use for that $30,000 screened porch. In real estate, customization can be risky.

As someone with a background in finance, I often advise clients to ask: "Is this upgrade for resale, or for me?" If it’s purely personal and you’re planning to stay for another 10 years, fine. But if you’re even thinking about selling in the near future, it may be time to consider other options.

3. Renovations Often Bring Unexpected Hassles

No matter how well you plan, renovations have a way of throwing curveballs. Permits get delayed. Costs go over budget. Timelines stretch.

I remember one Beaufort couple who planned a "quick" bathroom remodel. What was supposed to take three weeks turned into three months when contractors uncovered outdated plumbing and mold behind the walls. It was a stressful experience, made worse by the disruption to their daily routines.

Even smaller projects can be exhausting when you’re living in the middle of it. Dust, noise, strangers coming and going—it all adds up. For folks who are ready to enjoy a slower pace of life, that kind of chaos can be more than just inconvenient.

And don’t forget the hidden costs. These are the things people often overlook when planning a renovation:

Hidden Costs of Renovating

- Permit Delays: Waiting weeks—or even months—for approvals can halt your project before it begins.

- Mold or Asbestos Mitigation: These common surprises behind walls can tack on thousands in unplanned expenses.

- Temporary Housing: If your kitchen or bathrooms are torn apart, you might need to stay elsewhere—at a cost.

- Emotional Fatigue: Constant noise, dust, and disruption take a toll on your peace of mind and routines.

Sometimes the biggest cost of renovating isn’t financial—it’s the disruption to your life. That’s something many folks only realize once they’re knee-deep in drywall.

4. Selling Can Unlock Lifestyle and Financial Flexibility

Here’s the bright side: selling your current home can offer more than just relief from upkeep and renovations. It can unlock equity that opens the door to a new chapter—one that’s more comfortable, affordable, and in tune with your lifestyle.

Maybe that means downsizing to a single-story home in a walkable neighborhood. Maybe it’s moving closer to your grandchildren. Or maybe you’re ready to travel more and want a home base that requires less upkeep.

Whatever your dream, selling can help you get there. Many of my clients are surprised at how freeing it feels to simplify. Less yard to mow. Fewer rooms to clean. And sometimes, no stairs at all.

One retired teacher I worked with traded her 4-bedroom house for a two-bedroom cottage in Atlantic Beach.

“I didn’t realize how much space—and stress—I was carrying until I let it go. Downsizing to my little cottage in Atlantic Beach felt like taking off a heavy coat I didn’t know I was wearing.” — Retired Teacher & Former Homeowner in Carteret County

That single move didn’t just lighten her monthly bills. It lightened her whole lifestyle.

5. Today’s Market May Be on Your Side

The real estate market has shifted in recent years, and while interest rates have climbed, inventory remains relatively tight in many coastal areas like Carteret County. That can work in your favor.

Homes that are well-maintained, priced right, and located in desirable areas—especially those close to the coast or with retirement-friendly layouts—are still seeing strong interest.

Buyers are looking for move-in-ready homes, not renovation projects. If you’re already thinking about selling, now could be the right time to list and avoid the risk of future market softening.

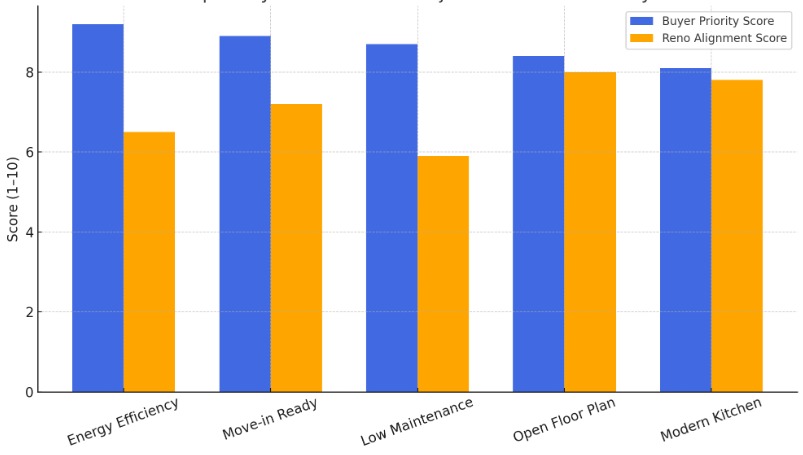

To help visualize the current gap between what buyers want and what major renovations often deliver, here’s a quick look at the top priorities of today’s homebuyers compared to how well typical renovation projects align with those needs:

As you can see, buyer demand is highest for energy efficiency, move-in readiness, and low-maintenance features—things that don’t always require a full-scale renovation. In fact, spending tens of thousands on custom upgrades may not check the boxes today’s buyers care most about.

As a Realtor with a CCIM designation and decades of experience analyzing financial markets, I keep a close eye on local trends. And right now, our area is still drawing steady interest from retirees, second-home buyers, and folks looking to relocate from urban centers.

When Renovating Still Makes Sense

Of course, I’m not saying selling is right for everyone. If your home suits your needs, your mortgage is manageable, and you’re emotionally tied to the place, a well-planned renovation might serve you well.

For example, converting a rarely used dining room into a home office or upgrading your HVAC system for better efficiency can enhance your quality of life without overextending your budget.

But even then, it’s wise to get advice from a professional. Before investing $50,000 into a project, consider speaking with a real estate agent or financial advisor who can help you assess whether the investment makes long-term sense.

To help you think it through, here’s a quick cheat sheet to see if renovating may be the right move for you:

Cheat Sheet: When Renovating Might Be Right

Ask yourself these Yes/No questions:

1. Do you love your current neighborhood and want to stay long-term?

→ YES = Renovating may make more sense.

2. Are the needed changes functional (like fixing HVAC or plumbing) rather than purely cosmetic?

→ YES = Renovating adds lasting value.

3. Can you comfortably afford the renovation without dipping into retirement funds or taking on debt?

→ YES = Renovation is financially safer.

4. Will the upgrades improve accessibility or safety as you age (like walk-in showers, ramps, or single-level living)?

→ YES = Renovation supports future needs.

5. Is your attachment to the home strong enough that moving would be emotionally difficult?

→ YES = Your peace of mind may be worth the remodel.

If you answer “yes” to at least 3 out of 5, renovation might be a better fit for your lifestyle and long-term goals.

Not Sure What’s Right for You? Here’s a Simple Framework

If you’re still on the fence, here’s a helpful way to think through the decision. Start by answering the questions below—and be honest with yourself. Sometimes, clarity comes not from asking what you should do, but what you want your life to look like in the next 5 to 10 years.

Renovate or Sell? Decision-Making Checklist

Answer the following 5 questions honestly. Count how many times you answer “Yes.”

✅ Do I plan to stay in this home for at least the next 5–10 years?

✅ Can I comfortably afford the renovation without sacrificing retirement savings or taking on debt?

✅ Will the improvements meet buyer expectations, or are they just for my personal preferences?

✅ Am I physically and emotionally prepared for the stress and disruption of remodeling?

✅ Would selling allow me to enjoy more freedom, flexibility, or a lifestyle I’ve been putting off?

Results:

4–5 YES answers: Renovating may be the right path. Your home still fits your lifestyle, and the upgrades are likely worth the investment.

2–3 YES answers: You’re in a gray area. Consider talking with a real estate professional who can walk through both scenarios with you.

0–1 YES answers: Selling could offer you more peace of mind, freedom, and financial flexibility—especially if the home no longer fits your lifestyle.

Final Thoughts

As someone who’s helped many empty nesters navigate this decision, I can tell you there’s no one-size-fits-all answer. But there is a best choice for you. It starts with honest reflection, thoughtful planning, and good guidance.

If you’d like to explore whether selling makes sense for your situation, I’d be honored to help. At Star Team Real Estate, we combine deep local knowledge with financial insight to help you make confident, informed decisions about your next chapter. You can reach me directly at 252-727-5656—I’d be happy to talk through your options, no pressure, just good conversation.